Surging Oil Prices Drive a Rally in Green Stocks

by: Anastasia Amoroso (iCapital Network)

While investors recognize that renewables are the future of energy, fossil fuels are likely to retain their dominant position in the near term.

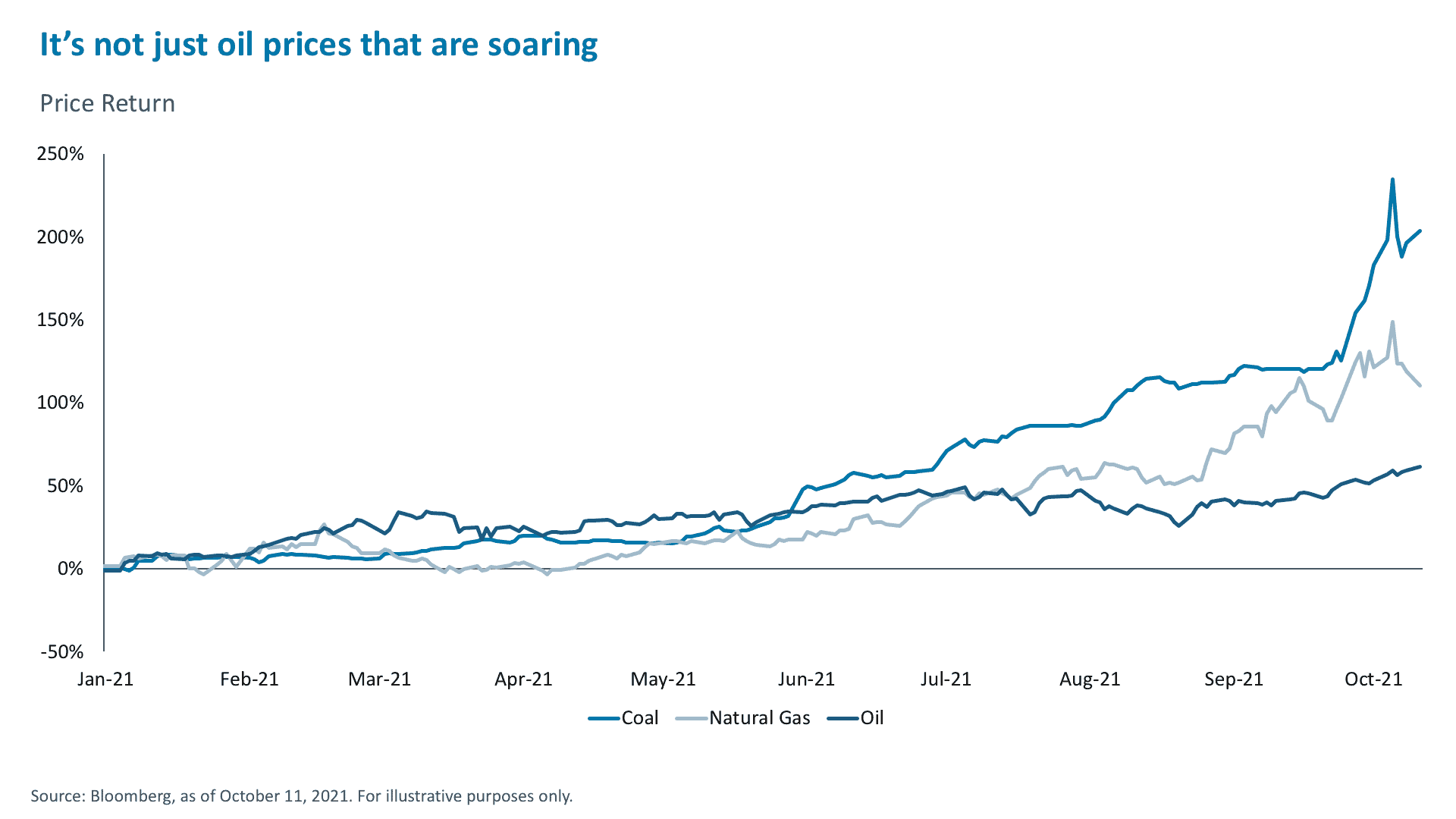

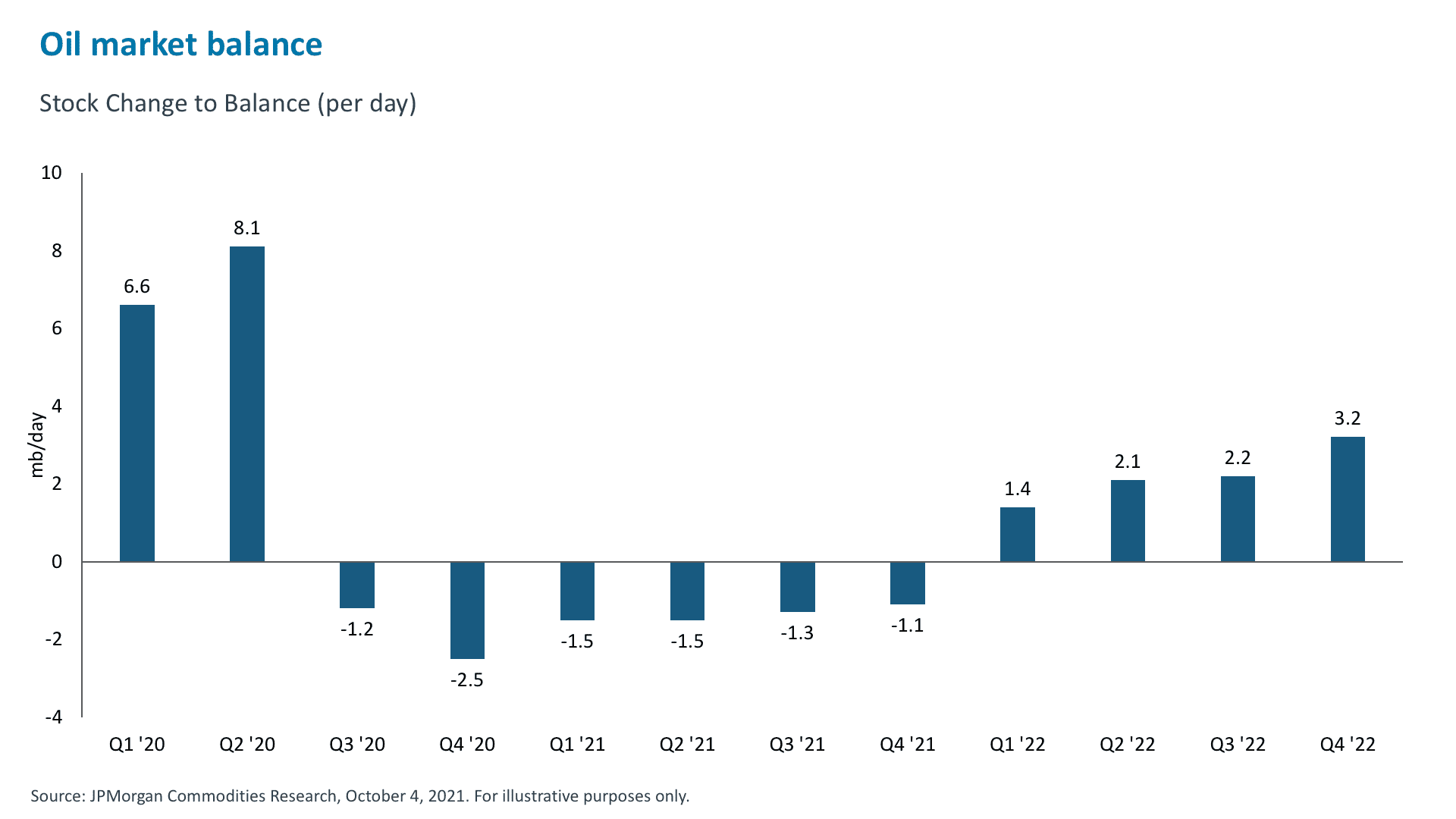

Oil surged to $80 per barrel this week, its highest level since 2018, and prior to that, 2014.1 Equity markets fell as memories of $100+ oil and fears of a demand decline spooked investors. News articles playing up rising input costs from steel, chemicals, and utilities, and the shuttering of power plants or factories due to fuel shortages don’t help sentiment. But notably, two sectors are in the green so far this week, no pun intended: clean energy and electric vehicle (EV) stocks. This begs a question – will surging oil prices and fuel shortages prompt faster switching to renewables?

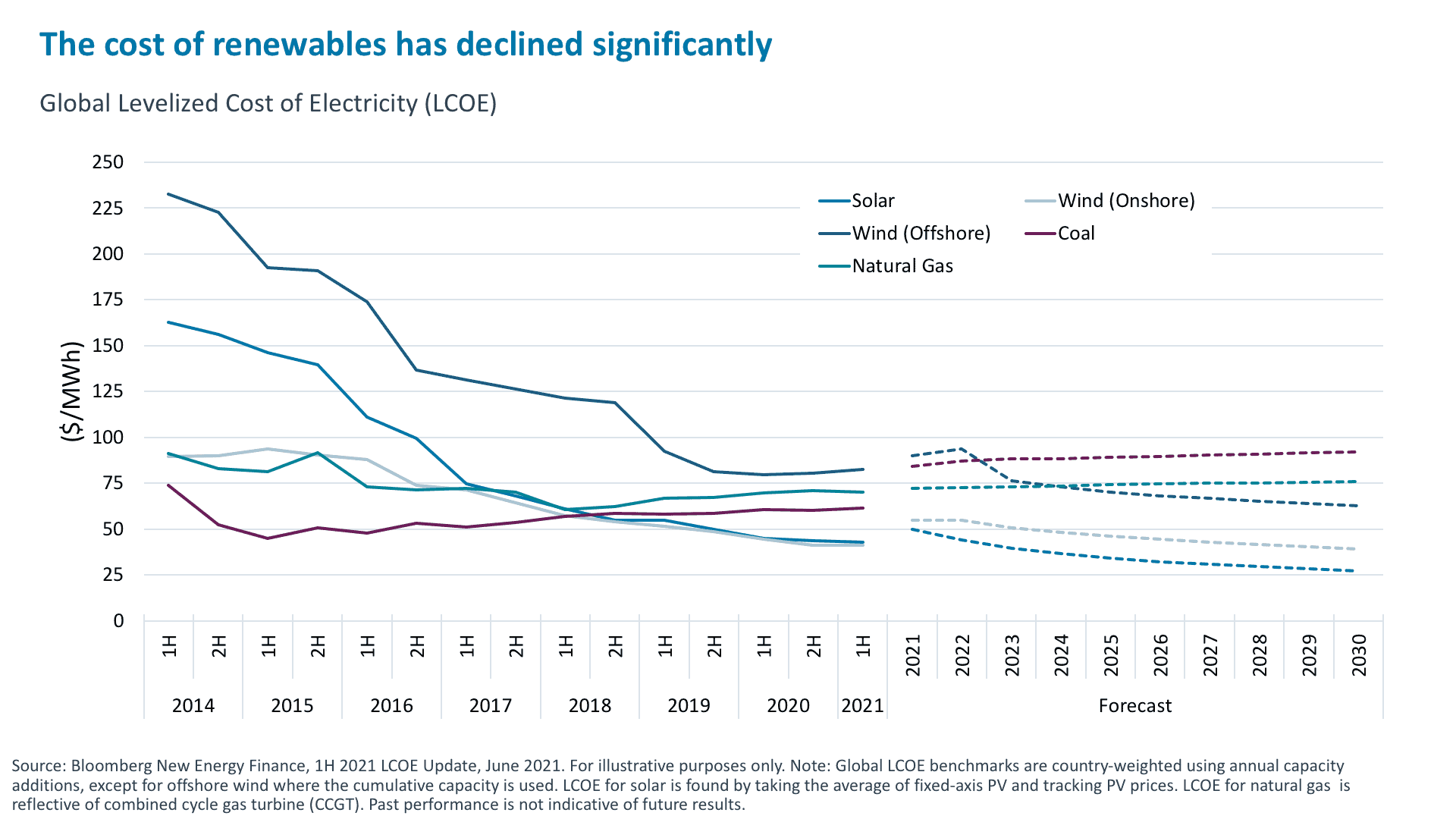

In this week’s commentary, we examine why oil is likely to retain its dominance – for the moment. First, the global energy infrastructure is not ready for renewables to take over yet. With roughly 70% of CO2 covered by net-zero pledges,2 however, the world should not revert back to a full reliance on oil and coal either. Instead, in our view, the push to diversify energy sources to include more renewables should accelerate, especially as the surge in the price of oil, coal, and natural gas makes the economics of renewables look even better.

Oil surged to $80 per barrel this week, its highest level since 2018, and prior to that, 2014.1 Equity markets fell as memories of $100+ oil and fears of a demand decline spooked investors. News articles playing up rising input costs from steel, chemicals, and utilities, and the shuttering of power plants or factories due to fuel shortages don’t help sentiment. But notably, two sectors are in the green so far this week, no pun intended: clean energy and electric vehicle (EV) stocks. This begs a question – will surging oil prices and fuel shortages prompt faster switching to renewables?

In this week’s commentary, we examine why oil is likely to retain its dominance – for the moment. First, the global energy infrastructure is not ready for renewables to take over yet. With roughly 70% of CO2 covered by net-zero pledges,2 however, the world should not revert back to a full reliance on oil and coal either. Instead, in our view, the push to diversify energy sources to include more renewables should accelerate, especially as the surge in the price of oil, coal, and natural gas makes the economics of renewables look even better.

Oil surged to $80 per barrel this week, its highest level since 2018, and prior to that, 2014.1 Equity markets fell as memories of $100+ oil and fears of a demand decline spooked investors. News articles playing up rising input costs from steel, chemicals, and utilities, and the shuttering of power plants or factories due to fuel shortages don’t help sentiment. But notably, two sectors are in the green so far this week, no pun intended: clean energy and electric vehicle (EV) stocks. This begs a question – will surging oil prices and fuel shortages prompt faster switching to renewables?

In this week’s commentary, we examine why oil is likely to retain its dominance – for the moment. First, the global energy infrastructure is not ready for renewables to take over yet. With roughly 70% of CO2 covered by net-zero pledges,2 however, the world should not revert back to a full reliance on oil and coal either. Instead, in our view, the push to diversify energy sources to include more renewables should accelerate, especially as the surge in the price of oil, coal, and natural gas makes the economics of renewables look even better.

Oil surged to $80 per barrel this week, its highest level since 2018, and prior to that, 2014.1 Equity markets fell as memories of $100+ oil and fears of a demand decline spooked investors. News articles playing up rising input costs from steel, chemicals, and utilities, and the shuttering of power plants or factories due to fuel shortages don’t help sentiment. But notably, two sectors are in the green so far this week, no pun intended: clean energy and electric vehicle (EV) stocks. This begs a question – will surging oil prices and fuel shortages prompt faster switching to renewables?

In this week’s commentary, we examine why oil is likely to retain its dominance – for the moment. First, the global energy infrastructure is not ready for renewables to take over yet. With roughly 70% of CO2 covered by net-zero pledges,2 however, the world should not revert back to a full reliance on oil and coal either. Instead, in our view, the push to diversify energy sources to include more renewables should accelerate, especially as the surge in the price of oil, coal, and natural gas makes the economics of renewables look even better.