How Big Tech Is Investing for the Future

by: Anastasia Amoroso

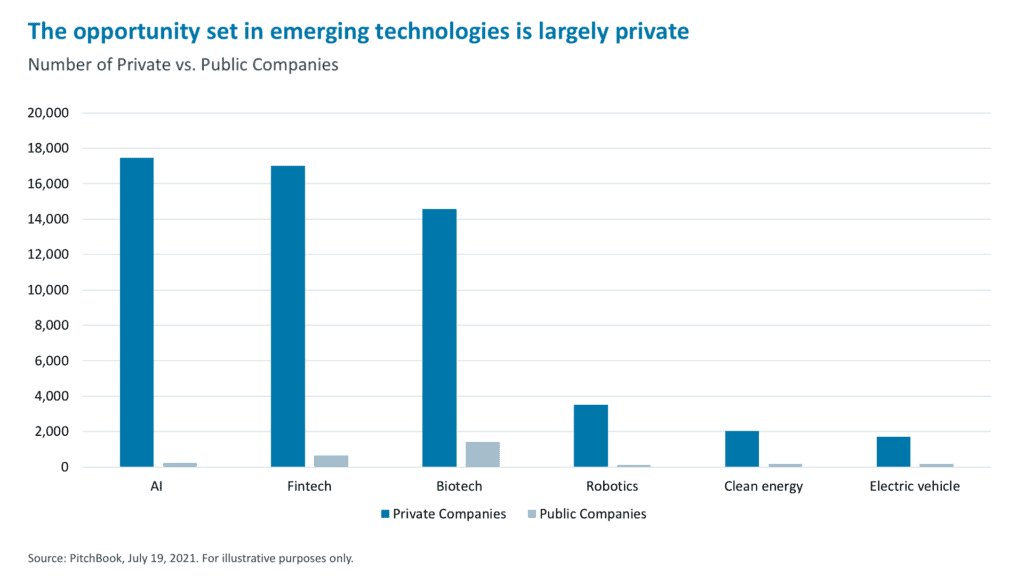

Amid a record-breaking earnings season, tech companies are seeking to future-proof their earnings growth by investing in private healthcare, autonomous mobility, and climate tech companies

All eyes are on Big Tech companies and their earnings

Google, Apple, Microsoft, Facebook, and Amazon report second quarter earnings this week and are likely to announce record or near-record profitability and earnings growth rates. It might be easy to dismiss this as a one-off quarter because of the challenging second quarter in 2020 and the acceleration of all things digital during the pandemic. But what’s stunning is that these megacap behemoths that account for $6.7 trillion of market cap have been reporting stellar earnings growth for years, with quarterly revenue growth averaging over 20% since 2011. This growth rate might be expected for younger, quickly accelerating businesses but for large, established businesses, it’s extraordinary.

How Big Tech Is Investing for the Future

by: Anastasia Amoroso

Amid a record-breaking earnings season, tech companies are seeking to future-proof their earnings growth by investing in private healthcare, autonomous mobility, and climate tech companies

All eyes are on Big Tech companies and their earnings

Google, Apple, Microsoft, Facebook, and Amazon report second quarter earnings this week and are likely to announce record or near-record profitability and earnings growth rates. It might be easy to dismiss this as a one-off quarter because of the challenging second quarter in 2020 and the acceleration of all things digital during the pandemic. But what’s stunning is that these megacap behemoths that account for $6.7 trillion of market cap have been reporting stellar earnings growth for years, with quarterly revenue growth averaging over 20% since 2011. This growth rate might be expected for younger, quickly accelerating businesses but for large, established businesses, it’s extraordinary.

Investing to maintain earnings growth power

It’s not a surprise that, to maintain their ability to deliver impressive earnings growth and avoid being disrupted, big tech companies are keenly focusing on investing for the future – either organically or through acquisitions and investments. The five big tech companies are projected to grow at an average two-year EPS CAGR of 21%. When adjusted for this growth, valuations for some of these tech names (on a PEG ratio basis) are cheaper than the S&P 500. Additionally, given recent acquisitions and investments, the true growth potential of big tech is likely underappreciated and should become more evident in earnings as these newer businesses scale up.

Big tech has been a pandemic trade, but given the investments described above, we believe it’s much more than that. Investing in these companies is effectively buying optionality on the future widespread adoption of new technologies like AI, digital health, autonomous mobility, and climate tech, while benefitting from strong existing cash flow today.

Investing to maintain earnings growth power

It’s not a surprise that, to maintain their ability to deliver impressive earnings growth and avoid being disrupted, big tech companies are keenly focusing on investing for the future – either organically or through acquisitions and investments. The five big tech companies are projected to grow at an average two-year EPS CAGR of 21%. When adjusted for this growth, valuations for some of these tech names (on a PEG ratio basis) are cheaper than the S&P 500. Additionally, given recent acquisitions and investments, the true growth potential of big tech is likely underappreciated and should become more evident in earnings as these newer businesses scale up.

Big tech has been a pandemic trade, but given the investments described above, we believe it’s much more than that. Investing in these companies is effectively buying optionality on the future widespread adoption of new technologies like AI, digital health, autonomous mobility, and climate tech, while benefitting from strong existing cash flow today.