Finding Opportunities in Alternative Fixed Income

by: Joseph Burns

Hedge funds specializing in structured credit offer strong, diversified return potential.

While elevated valuations in equities are raising concerns for all investors, the structural challenges in traditional fixed income are causing additional problems for advisors – and these challenges are unlikely to be resolved anytime soon in most corners of the global bond market. Advisors seeking a solution may want to consider shifting a portion of the fixed income allocation to structured credit securities.

The most common reference for fixed income investors is the Bloomberg Barclays Aggregate Bond Index, which in the U.S. includes an approximate two-thirds weighting to Treasuries and corporates that span investment grade and high-yield securities, and a one-third weighting to securitized credit. As of mid-June 2021, the 10-year Treasury bond yields less than 1.5%, single-A corporate bonds are trading with an effective yield of 1.8%, and high yield has become a complete misnomer with sub-investment grade bonds yielding just 3.1%. With historically low yields and the potential for rising rates, the combination of credit and duration risk has arguably never been higher for fixed income investors in the popular Treasury and corporate sectors.

Inefficiency yields a unique return source

Within a $60 trillion fixed income market, roughly $20 trillion comprises residential, commercial, and asset-backed securities along with collateralized, senior-secured loans. The vast majority of these securities – nearly 85% – are government-sponsored enterprises, including Fannie Mae and Freddie Mac, and the Federal Housing Administration, Department of Veterans Affairs, and Department of Agriculture loan programs. This leaves approximately $3.5 trillion of non-agency structured credit securities, a market that provides a unique source of returns for specialist investors.

Structured credit securities are generally under-followed, highly inefficient, and offer significant flexibility across a diverse set of sub-sectors, asset types, credit ratings, and instrument structure (e.g., floating versus fixed rate, amortizing versus non-amortizing, etc.). These inefficiencies provide an opportunity for advisors and clients to increase the return potential of their overall portfolio by diversifying away from traditional investment grade, high yield, and Treasury securities.

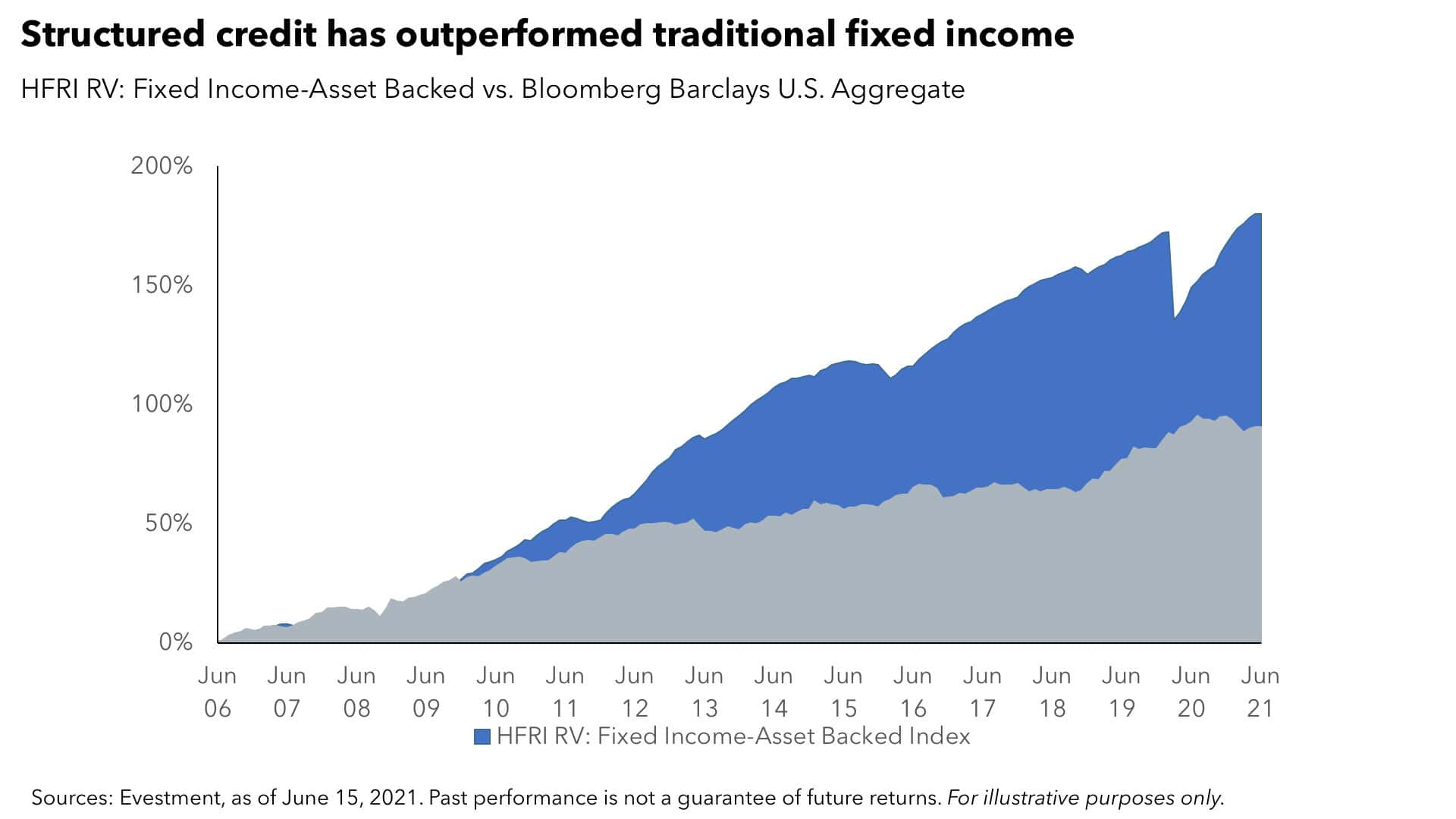

This comparative inefficiency is not a new phenomenon, as select funds have generated significant outperformance over the long term. The following chart highlights the performance of the Bloomberg Barclays Aggregate Bond Index compared to the HFRI RV: Fixed Income-Asset Backed Index. Over the past 15 years, the hedge fund index has effectively doubled the return of the traditional bond index, with cumulative performance of 180%, versus 91% for the Aggregate Bond index. This equates to an annualized outperformance of roughly 275 basis points per year between June 2006 and May 2021.

Bottom line: In the current environment, strong equity performance may be masking the higher risk and lower return potential in bond markets. However, should stocks falter and fixed income fail to provide the expected ballast, clients will undoubtedly wonder what is happening with the 40% of their capital that is often allocated to traditional bonds.

Experience required

Securitized credit offers the potential for a significant increase in returns through exposure to an inefficient asset class requiring deep domain experience, differentiated sourcing capabilities, and proven risk management capabilities. Several hedge funds specializing in this area have outperformed traditional fixed income over the past 10 to 15 years, and in the current environment have an opportunity to provide diversifying performance that is not readily available in traditional fixed income securities.